Get insights.

Unlock value.

- 14-day free trial

- Set up in minutes

- No credit card required

5 Best Finance Assessment Tools to Measure Capability, Risk & Financial Health

Imagine this: you’re a finance advisor sitting opposite to your client. They’re overwhelmed, unsure if they can retire comfortably, worried about debt, or maybe struggling with unexpected financial shocks. They trust you will provide solutions to their worries. You want to give them clarity, but without the right assessment tool, you’re relying on half-baked spreadsheets, scattered credit reports, and outdated questionnaires.

That guesswork doesn’t just waste time - it risks your credibility.

What you really need is an AI-powered, privacy-focused finance assessment tool that helps you measure financial capability, risk, and health. So you can guide your clients with confidence.

The Best AI Risk Assessment Tools for Finance Professionals

Finance professionals today are turning to AI risk assessment tools that don’t just collect data, but also analyze patterns, score risks, and deliver actionable insights. The right platform should be secure (clients share sensitive financial data), flexible (every client’s needs are different), and smart enough to handle both prebuilt assessments and fully custom scenarios.

Here are the top 5 finance assessment tools that stand out, with BlockSurvey leading the list.

1. BlockSurvey - AI-Powered, Privacy-Focused, Ready-to-Use or Build Your Own

BlockSurvey isn’t just another survey tool - it’s a finance assessment platform built for the modern advisor. What sets it apart is its AI capabilities (automated scoring, insights, and reporting) combined with blockchain-backed privacy. You can either:

- Use prebuilt templates like the CFPB Financial well being scale and other Financial Wellness assessment templates.

- Or build your own finance assessment from scratch with formulas, logic, and scoring. If you have the assessment doc just import it to blocksurvey to get your assessment live in minutes.

It’s as easy as drag-and-drop, but powerful enough to serve financial advisors, HR leaders, and business consultants who need secure, actionable insights. Want to collect anonymous client feedback? You can do that too.

Key Features for Finance Professionals:

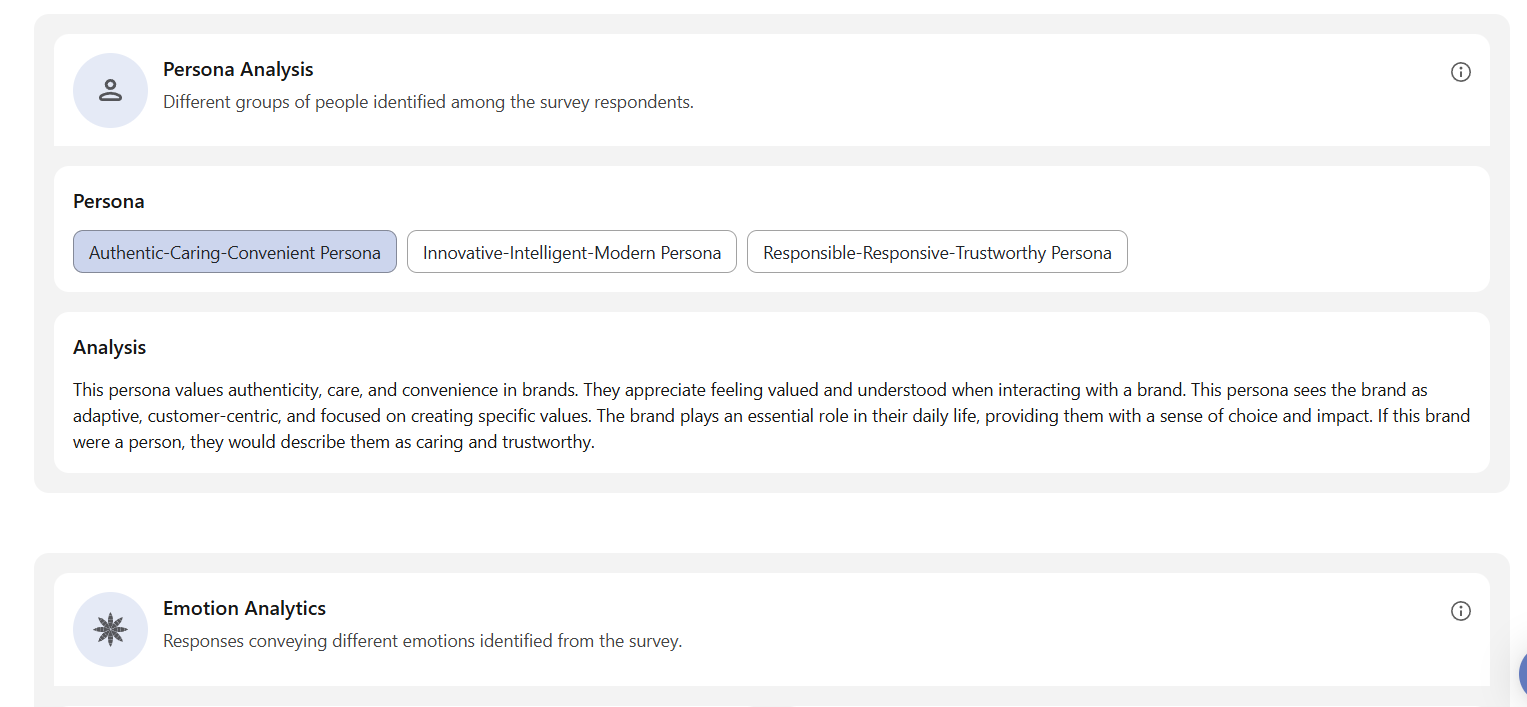

AI Scoring & Analytics

Our platform does the heavy lifting for you, automatically evaluating financial health and risk in minutes. No manual spreadsheets or guesswork - just smart insights that give you a clear picture of where your clients stand. The best part? Those insights are turned into simple, actionable reports you can share directly with clients, making conversations easier and decisions more informed.

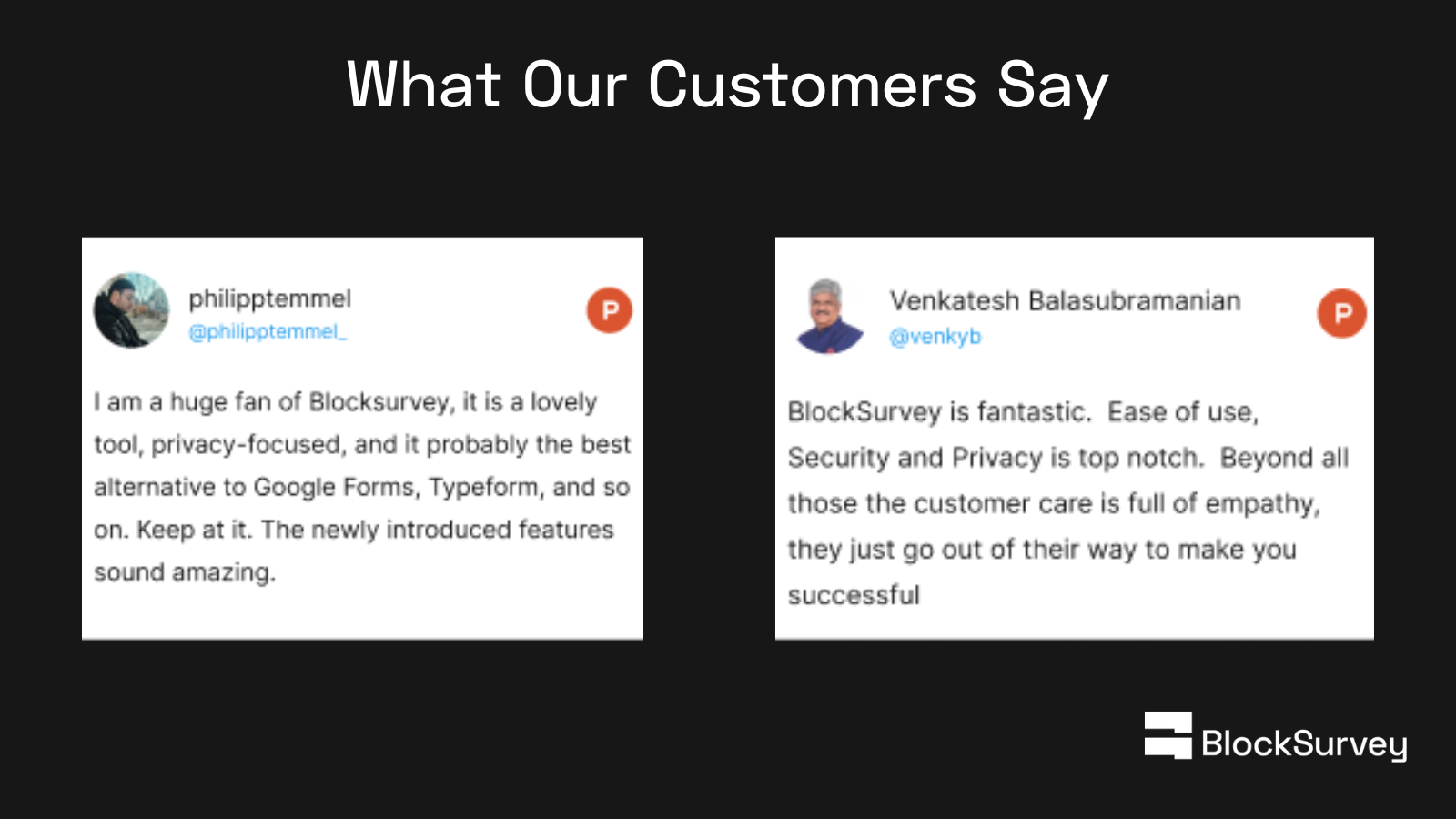

Privacy-First Design

Client trust is everything, and that starts with data security. That’s why we use end-to-end encryption, with zero-knowledge design, even Blocksurvey can’t peek into your data. Your clients know their information is safe, and you can feel confident that privacy is never compromised.

Prebuilt Templates

We make it easy to get started with ready-to-use assessments for financial wellness, capability, and risk. Built by experts, they save you hours of setup and let you launch in minutes. It’s the quickest way to start offering real value without slowing down your workflow.

Custom Assessments

Every practice is unique, so your assessments should be too. With custom surveys, you can add your own logic, formulas, and scoring to match your approach. This flexibility ensures clients get a tailored experience that feels relevant, personal, and aligned with the way you work.

White-Label Options

Your brand deserves the spotlight - not ours. With white-labeling, assessments carry your logo, your style, and your identity at every step. To clients, it looks and feels like it was built by you, helping strengthen trust and reinforcing your professional image.

Cons:

- Doesn’t support offline assessments

Pricing:

- Free trial available

- Paid plans start at $24/month. Checkout our pricing here.

Equifax

Equifax is widely used by businesses and advisors to dig into credit history and financial risk. It helps evaluate a company’s financial standing, exposure, and overall credit health. With its large datasets, it’s a trusted resource for making lending and advisory decisions. While it shines for business use, it’s not really built for individuals looking to self-assess.

Pros: Reliable business credit data, strong risk modeling.

Cons: Not for personal self-assessment, history of data breaches.

Pricing: Custom quoted for business use.

FICO Score Tools

FICO remains the benchmark for credit health, trusted by lenders and individuals worldwide. It’s best known for helping determine loan eligibility and default probability. Best investment property lenders and similar Institutions rely on its advanced analytics, while consumers use personal plans to track their own credit. However, it’s heavily credit-focused, so it doesn’t provide a full picture of financial wellness.

Pros: Globally trusted scoring system, advanced analytics for lenders.

Cons: Narrow focus on credit only, enterprise plans can be costly.

Pricing: Personal plans start at $29.95/month; enterprise pricing varies.

Morningstar Advisor Workstation

Morningstar’s platform is a go-to choice for advisors, combining client assessments, portfolio analysis, and investment research. It allows advisors to clearly present strategies backed by real data and insights. The tool helps elevate client conversations by turning complex analysis into actionable advice. While powerful, it requires time to learn and comes with a premium price tag.

Pros: Comprehensive toolkit for advisors, highly trusted brand.

Cons: Steeper learning curve, subscription is expensive.

Pricing: Starts around $127/month depending on package.

FINRA Financial Capability Tools

FINRA offers large-scale surveys and studies that measure financial literacy and capability across the U.S. These tools are valuable for understanding trends and benchmarking at a population level. They’re particularly useful for educators, researchers, and policymakers looking to improve financial education. However, they aren’t designed for individual client work or day-to-day advisory use.

Pros: Data-rich insights, great for research and education.

Cons: Not client-specific, limited customization.

Pricing: Free, public resource.

Why BlockSurvey Is the Ultimate Finance Assessment Solution

Here’s the bottom line: tools like Equifax,FICO, Morningstar and FINRA all have their strengths - but each comes with limits.

BlockSurvey, however, combines everything finance professionals actually need:

AI-powered insights for smarter risk and capability assessments, Privacy-first design so clients trust you with their most sensitive data, Ready-to-use templates for quick launches, Custom assessment builder for full flexibility, Affordable pricing starting at just $24/month all under on roof.

That’s why, for financial advisors, HR leaders, and consultants looking for an all-in-one AI risk assessment tool, BlockSurvey is the ultimate solution. Sign up now! Want to know how it works? Book a demo now!

5 Best Finance Assessment Tools to Measure Capability, Risk & Financial Health FAQ

How secure is BlockSurvey for client data?

BlockSurvey uses end-to-end encryption and blockchain-backed zero-knowledge design, meaning even BlockSurvey can’t access your client’s financial data.

Can I use BlockSurvey for both individuals and businesses?

Yes. You can create assessments for personal financial wellness as well as organizational or HR-focused assessments.

Do I need technical skills to set up assessments?

Not at all. BlockSurvey is drag-and-drop simple, with ready-made templates to get started instantly.

Can I customize the assessments to my practice?

Absolutely. You can add your own logic, formulas, and scoring to tailor assessments to your methodology.

Is there a free version of BlockSurvey?

Yes. BlockSurvey offers a free trial, with paid plans starting at just $24/month.

Get insights.

Unlock value.

- 14-day free trial

- Set up in minutes

- No credit card required